Wealth Inequality is a straw man. I.e. not looking at the real problem. Inflation.

Rich people reinvest their money into the economy. By funding startup companies.

These start up companies create jobs. More jobs, more people can work, more people make money.

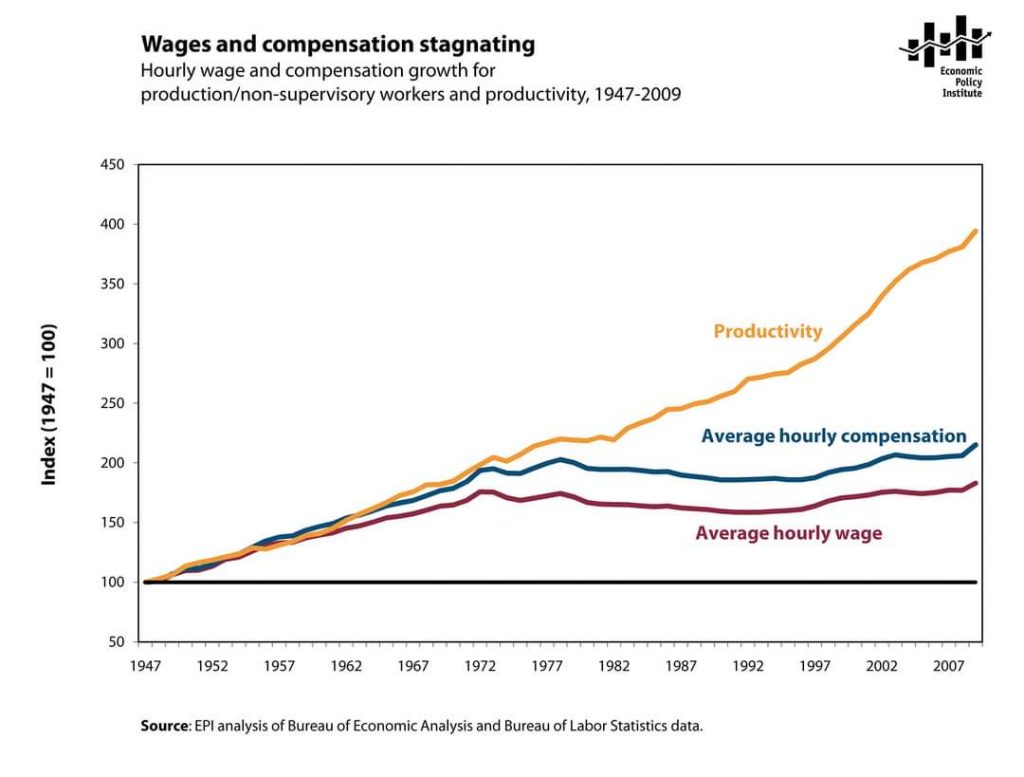

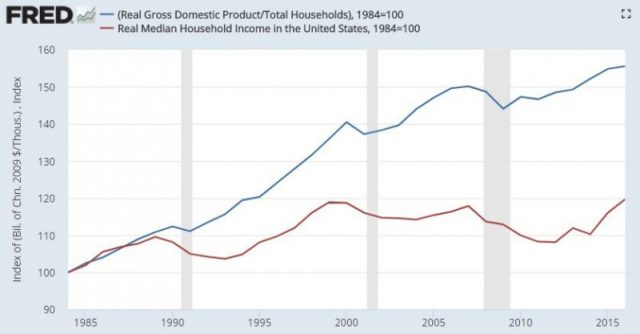

The divergence of inflation verse the average household income is a better comparison.

How do we go from majority being able to afford a house to today where most are struggling to find something in their price range.

This happened when the US went off the gold standard. By not having the dollar pegged to the price of gold, this allowed the government to inflate the value of dollar. When they inflate the value of the dollar. The average person’s spending power goes down. And that is what you see in the graph. Wages stay low while the price of things goes up.

Seriously??? this is a quote from a Guardian article complaining about the wealth gap.

“In 1978, the top 0.1% owned about 7% of the nation’s wealth. In 2019, the latest year of data available, they own nearly 20%.”

https://www.theguardian.com/commentisfree/2021/mar/29/rich-poor-gap-wealth-inequality-bernie-sanders

They claim the fix is raising the minimum wage. But that doesn’t fix the middle class. The middle class stay were they are and loose out on the raise that the lower class gets. The second side effect of raising the minimum wage is prices go up and nobody actually gets a raise.

https://www.forbes.com/sites/jackkelly/2019/07/10/the-unintended-consequences-of-the-15-minimum-wage/?sh=7b7ea29be4a7

But what happened in 1971? Nixon removes the US from the gold standard.

https://www.federalreservehistory.org/essays/gold-convertibility-ends

And inflation becomes the standard. Creating the divergence you see in the graph.

You can say “Tax the rich” to fix this problem. But that’s not a real solution. So how do we fix this divergence. How do we invert inflation? With deflation.

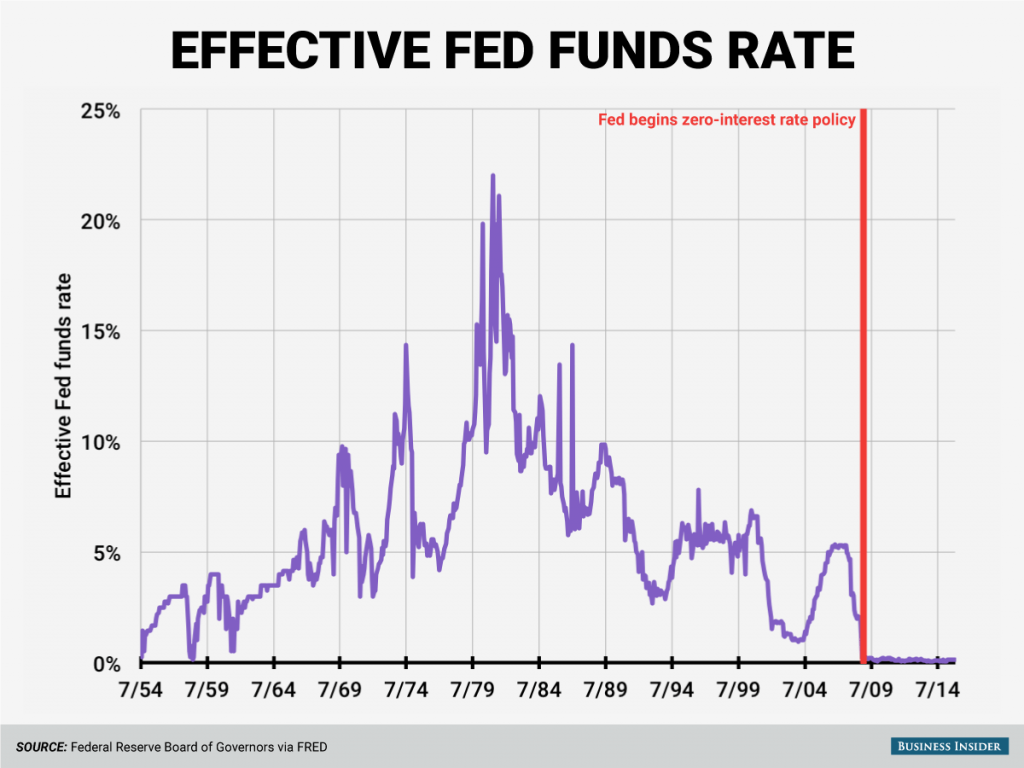

What is deflation? Or how do you bring it about? Increase the Fed interest rates.

This overlaid with the price/wage graph has a direct correlation. The divergence happened in 1980s and the peak of the fed rate was around 1982. It hasn’t been that high since. On top of that, it has been at an all time low since 2009. And wages have been relatively flat since 1998. We need to raise the fed rate.

I do have to add a caveat. The reason nixon removed the gold standard was due to the need that the government wanted more money without raising taxes. Remove the gold standard, print more money, now the government has more money. But that is why the fed rate was as high as it was at that time. The government wanted more and more money but couldn’t justify the continuation of raising the fed. The government should spend less and remove wasteful spending. Do a full audit and remove unnecessary programs.

But the rich does not want this to happen either. So they’ve created a pretty strong propaganda campaign to convince everyone that deflation is a bad thing. If they just invest in the US dollar and bonds during the deflationary period they would just make more money.

This is a better image of the split economy. It was the image that made me investigate what happened in 1972 that created this divide.

Source that sparked this discussion:

Is Wealth Inequality As Bad As We Are Told? Defending the Indefensible – How Money Works

https://youtu.be/tjQzpt8LeXI